In November 2025, the release of the "Co-loading Liposomes White Paper" marks that liposome technology has entered a new phase of industrialization and multi-scenario application in the food field. As an advanced delivery system with both biocompatibility and functional diversity, liposomes have rapidly extended from traditional application fields to food-related scenarios such as functional nutrition, food industry, and oral beauty, and their market pattern and technological evolution are undergoing profound structural changes. Combining the "Co-loading Liposomes White Paper 2025" and the latest industry data, this article focuses on the food field to analyze the current status characteristics and future development trends of the liposome market.

Since its birth in the 1960s, liposome technology has undergone basic research accumulation and application breakthroughs, and in recent years, it has shown a significant penetration and expansion trend in the food field. According to the literature retrieval data in the white paper, research on food-grade liposomes has accelerated since 2000, especially in the fields of "oral delivery" and "vitamin liposomes", forming three major development trends: first, basic research focuses on food applications, covering food science, nutritional delivery, food additives and other disciplines; second, the delivery objects expand from traditional food raw materials to functional ingredients such as plant extracts, probiotics, and antioxidant raw materials; third, the application scope is deeply rooted in the food field, achieving large-scale application in functional nutrition foods, health foods, special dietary foods, food additives and other fields.

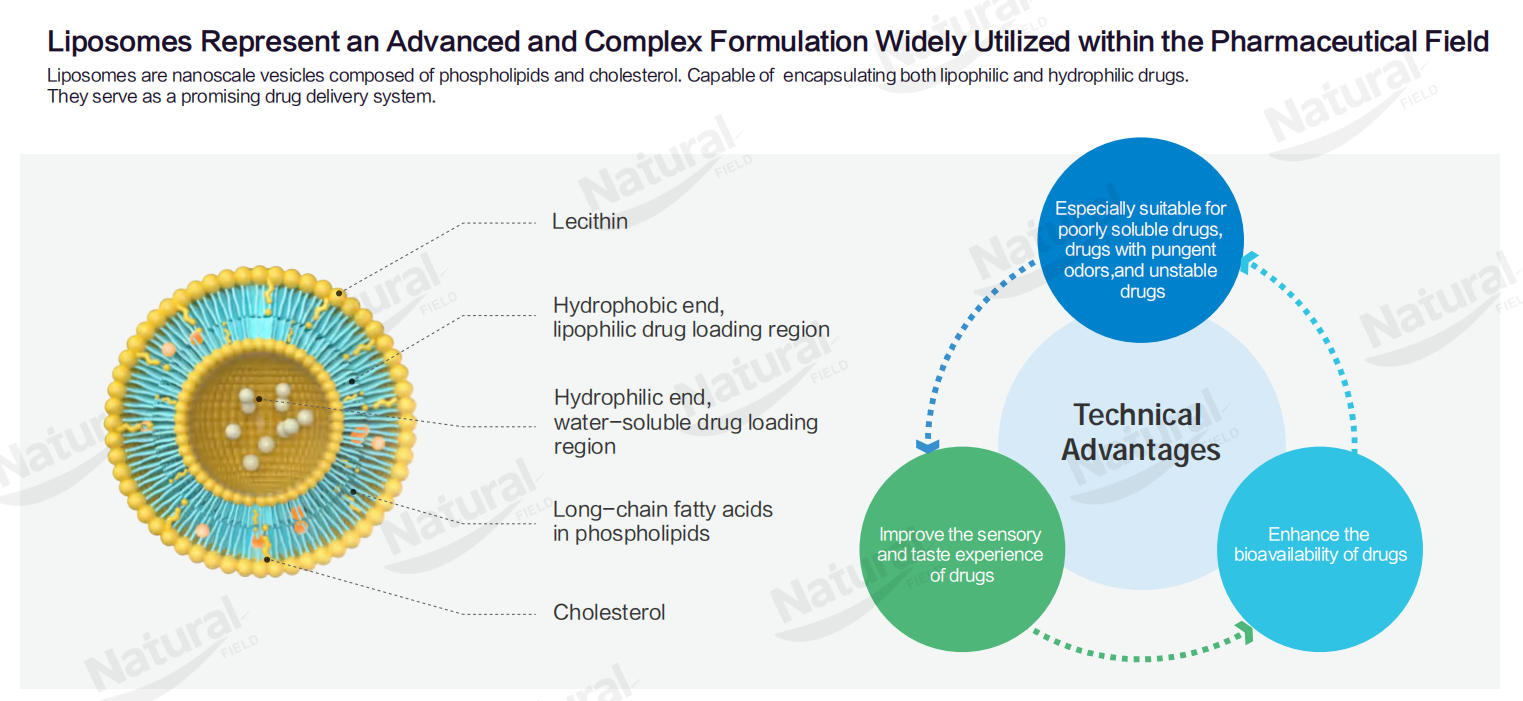

Behind this migration trend is the dual drive of consumption demand upgrading and industrial technological progress. In the functional food field, consumers' requirements for ingredient absorption efficiency and dosage form experience continue to improve, promoting liposomes from "high-end pharmaceutical carriers" to gradually become "standard technology for functional nutrition". For example, co-loading liposome technology has achieved an exponential increase in the bioavailability of insoluble ingredients such as coenzyme Q10 and curcumin, becoming the core support for high-end dietary supplements to build differentiated competitiveness.

The global food-grade liposome market maintains a high-speed growth trend. The market scale was approximately 5.23 billion US dollars in 2024, and it is expected to exceed 12.8 billion US dollars by 2034, with a compound annual growth rate of about 9.5%. Among the segmented tracks, the functional nutrition food field driven by consumers' health demand has a CAGR of 11%; the health food field is about 8.5%; the special dietary food field has a growth rate between 9-10%, becoming the core engine of growth.

China's food-grade liposome market has performed particularly well. In 2025, the market scale reached 6.85 billion yuan, of which functional nutrition food accounted for 55.2%, health food accounted for 30.1%, and special dietary food accounted for 12.7%. In terms of regional distribution, the Yangtze River Delta and Pearl River Delta contribute 72% of the market growth. The acceptance of liposome functional foods among consumers in first-tier and new first-tier cities reaches 63%, which is significantly higher than 38% in second- and third-tier cities.

The dosage form structure also shows an optimization trend: liquid liposomes still occupy the dominant share in the functional nutrition field, but non-liquid forms such as powder and hard capsules continue to grow rapidly due to their adaptability to more consumption scenarios. In terms of channels, the penetration rate of the "e-commerce + DTC model" is relatively high, reflecting that consumers' awareness and acceptance of liposome delivery technology have significantly improved.

The current food-grade liposome market has formed a competitive pattern of "food giants + innovative technology enterprises". In the functional nutrition field, leading enterprises such as BY-HEALTH and YANGSHENG TANG have deployed liposome products through technical cooperation, and their annual sales of coenzyme Q10 liposome capsules have exceeded 500 million yuan; on the technical supply side, enterprises such as Natural Field and Jiangsu Aoland have achieved breakthroughs relying on co-loading liposome technology, becoming core suppliers for food brands to achieve differentiated upgrading.

Cross-border integration competition has also emerged. Cosmetics enterprises have begun to explore the application of liposomes in oral beauty foods, and food ingredient CDMO service providers have ushered in development opportunities due to the growth of industrialization demand. It is worth noting that food safety standards have an important impact on the market pattern: the 2025 new version of the "Standards for the Use of Food Nutritional Fortifiers" added regulations on the use of 3 types of liposome-encapsulated nutrients, promoting the market share of compliant products to increase from 45% in 2022 to 68%.

The core technological breakthroughs disclosed in the "Co-loading Liposomes White Paper" are reshaping the application boundary and value space of liposomes. Its core innovations are concentrated in three major dimensions:

Membrane Material Revolution: Using rare ginsenosides (Rg3, Rh2, etc.) instead of traditional cholesterol to construct phospholipid bilayers, enabling the carrier itself to have nutritional synergy, realizing the dual value of "delivery + nutrition", while avoiding cholesterol intake restrictions for some people and expanding the scope of food application.

Stability Improvement: The steroid mother nucleus structure of rare ginsenosides provides better rigid support than cholesterol, significantly enhancing the physical stability of liposomes in high-temperature, acid-base environments during food processing and long shelf life, and reducing food production losses.

P-gp Inhibition Mechanism: Inhibiting the efflux function of gastrointestinal P-glycoprotein through dual mechanisms, opening a "green channel" for nutrient absorption. Experimental data show that the relative absorption rate of food-grade coenzyme Q10 co-loading liposomes is 7.86 times that of ordinary added forms; the bioavailability of curcumin co-loading liposomes in food reaches 8.72 times that of the free state.

In addition, innovative directions in the food field such as probiotic liposome encapsulation technology and plant polyphenol delivery systems have also made phased progress. The localization breakthrough of microfluidic production equipment has increased the encapsulation rate of food-grade liposomes from 85% to 93%, and reduced production costs by 40%, laying a solid foundation for the industrial application of technical food.

Food-grade liposome technology will evolve towards a more efficient and food processing-adaptive direction. First, hybrid liposomes have become a research hotspot. Through the integration of liposomes and food-grade polymers, multiple improvements in food processing stability, controlled release, and taste compatibility are achieved. For example, the retention rate of polymer-coated liposomes in baked food can be increased by 2-3 times. Second, targeted release systems are accelerating commercialization. Designs such as intestinal pH sensitivity and enzyme response will realize "precision intestinal colonization" in probiotic foods. Third, intelligent production is popularized. AI technology is used for the optimization of food-grade liposome formulations, and continuous flow production equipment increases the production capacity of food ingredients by more than 50%, significantly improving product uniformity.

International market research shows that the in-depth integration of nanotechnology and liposomes will spawn more food innovations, such as liposome-nanofiber composite carriers, which can deliver both fat-soluble and water-soluble nutrients simultaneously, realizing "nutritional balance integration" of food.

In the next five years, the application of liposomes in the food field will present a dual pattern of "scenario segmentation + function deepening". In the functional food field, precision nutrition food is still the core track. Customized liposome nutrition products for children, the elderly, and sports people are expected to have a market scale of 8.5 billion yuan by 2030; the oral beauty food field is ushering in an outbreak period. The commercialization process of liposome-encapsulated collagen, astaxanthin and other products is accelerating. Related products of enterprises such as Marubi and Bloomage Biotechnology have entered the trial sales stage, and will cover 15 million female consumer groups after listing.

The consumer field has greater growth potential: in the oral beauty market, co-loading liposome preparations of ingredients such as glutathione and astaxanthin are expected to grow at an annual rate of more than 15% due to their dual advantages of transdermal and oral administration; in the sports nutrition field, liposome products such as creatine and amino acids can improve post-exercise recovery efficiency, becoming a new choice for professional athletes and fitness people. In addition, emerging scenarios such as pet nutrition and agricultural biological agents will also gradually open up.

The localization construction of food-grade supply chains will become the key for China's liposome industry to build core competitiveness. At present, domestic key auxiliary materials such as food-grade phospholipids still rely on imports. In the future, with the capacity expansion of enterprises such as Shandong Zhongmu and Shanghai Kaisai (the capacity utilization rate of food-grade phospholipid production lines has reached 115%), the domestic substitution rate is expected to increase from 30% in 2025 to 65% in 2030, further reducing industrial production costs. At the same time, the industry-university-research collaborative innovation system accelerates technology transformation. More than 15 liposome innovation centers co-founded by universities such as Jiangnan University and China Agricultural University and food enterprises have been established, covering the whole-chain technology research and development from food-grade formula research to pilot-scale amplification.

In terms of business model, "technology platform + food scenario solution" has become the mainstream. For example, Natural Field provides food brands with integrated services from liposome formula design to production implementation, helping customers achieve product function upgrading; the intervention of cross-border e-commerce channels also paves the way for liposome foods, with annual sales of single categories exceeding 300 million yuan.

Liposome technology in the food field is in a critical period of transformation from "functional auxiliary material" to "core nutrition solution platform". In the development blueprint outlined in the "Co-loading Liposomes White Paper 2025", the development path centered on co-loading technology breakthroughs, precision delivery food upgrading, and industrial ecological coordination is clear. In the next decade, with the continuous emergence of technological breakthroughs and the continuous expansion of food application scenarios, liposomes will become an important engine for food industry innovation, and more importantly, the core driving force for the upgrading of the big health food industry, bringing consumers more efficient and safer nutritional food solutions.