Nano scale lipid vesicles encapsulate nutrients such as vitamin C, glutathione, and coenzyme Q10, quietly crossing the barrier of the digestive system and entering human cells with unprecedented efficiency - this seemingly small "absorption revolution" is giving birth to a new market worth billions.

With the increasing awareness of health, global consumers are no longer satisfied with traditional nutritional supplements and are instead pursuing products with higher bioavailability. Liposome technology is accelerating its migration from the pharmaceutical field to the nutritional food market due to its ability to significantly improve the absorption efficiency of nutrients.

According to Data Bridge Market Research, the global market size for liposome vitamins and minerals has reached 415 million US dollars in 2024, and is expected to grow to 735 million US dollars by 2032, with a compound annual growth rate of up to 8.10%.

This technological revolution is reshaping the competitive landscape of the nutritional food industry.

There has long been a fundamental contradiction in the field of nutritional supplementation: consumers consume large amounts of nutrients, but their actual absorption and utilization rates are low due to the breakdown barriers and cellular absorption limitations of the digestive system. The emergence of liposome technology is precisely aimed at this pain point.

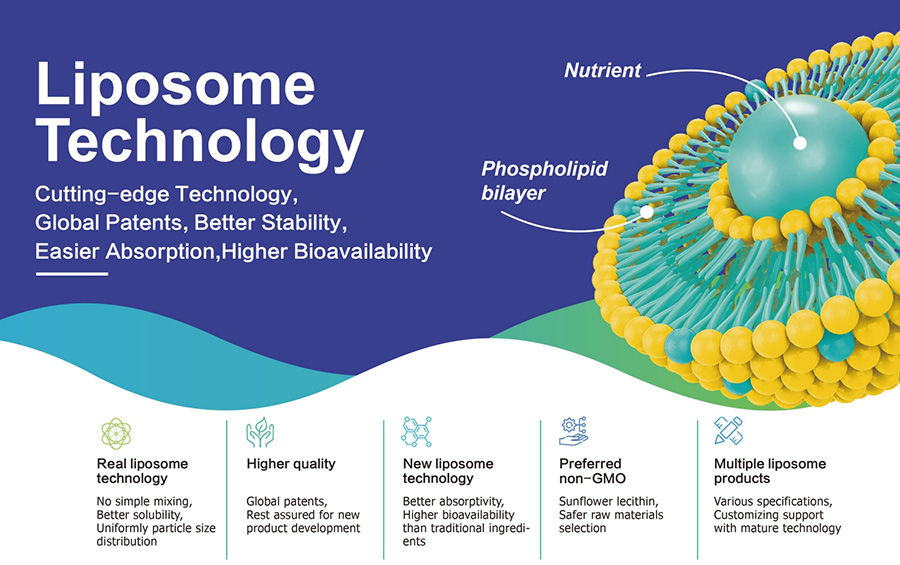

Liposomes are small spherical vesicles composed of phospholipid bilayers, with a structure similar to that of human cell membranes. This similarity enables liposomes to effectively fuse with the cell membrane, delivering the nutrients they encapsulate directly into the cell.

Compared with traditional supplements, liposomes have significant advantages in protective delivery ability. It can protect vulnerable active ingredients such as vitamin C and glutathione from safely passing through the gastrointestinal tract, preventing their degradation during digestion.

Research has shown that liposome encapsulation technology can increase the bioavailability of nutrients several times. For example, the bioavailability of liposome green tea extract can be increased by 10 times, and the bioavailability of liposome vitamin B-12 can be increased by 6 times.

A study published in the Journal of Nutrition in 2022 confirmed that the plasma concentration of liposome vitamin C is significantly higher than standard vitamin C, demonstrating its superior bioavailability and absorption rate in the human body.

From a regional market perspective, North America currently holds the dominant position in the global liposome nutrition market, with a market share of up to 40.5%. This is due to the high consumer awareness, well-established healthcare system, and strong preference for advanced supplement technology in the region.

However, the fastest-growing honor belongs to the Asia Pacific region, with an expected market share of 30.5% during the forecast period. This growth is mainly driven by the rapid increase in healthcare awareness, the rise in disposable income, and the increasing demand for advanced nutritional supplements.

In terms of product form, capsule products are expected to occupy the largest share (45.5%) of the liposome vitamin and mineral market by 2025 due to their convenience, ease of consumption, and cost-effectiveness. Capsules provide consumers with a reliable and familiar way of administration, ensuring accurate dosage and excellent shelf life.

In terms of product type distribution, liposomal vitamin C is the most popular niche market, followed by liposomal glutathione, liposomal curcumin, and liposomal vitamin D. These products mainly meet the needs of immune support, anti-aging, and overall health.

The global liposome nutrition market has formed a diversified competitive landscape, with major players including LivOn Labs, Quicksilver Scientific, NOW Foods, Natural Field, and Thorne.

These brands each have their own unique features, such as Quicksilver Scientific being a major producer of liposome nutrition products in the North American market, while Life Extension has launched an innovative liposome vitamin C formula that combines vitamin C with liposome delivery systems.

The Japanese brand Lipo Capsule has been launching Lipo-C, a liposomal vitamin C product, since 2015, and will launch Lipo-C C+D, a liposomal vitamin C+D product, in 2023. It is worth noting that some pharmaceutical companies have also begun to layout in this field with their technological advantages, such as Ito Pharmaceutical Co., Ltd. launching the liposome nutrition product "LIPOCERA" in 2024 ® White Moist Shot”。

In the Chinese market, KIDNOW, a brand under Jincheng Biotechnology, has launched products such as Liposome Glutathione White Tablets under the slogan of "True Technology&Zhen Ingredients", emphasizing the combination of high-quality raw materials and liposome technology.

Chinese nutrition and health raw material supplier Natural Field Co., Ltd. launches NF Lipo ® The participation of Chinese companies in the field of liposome technology, including the use of liposome series raw materials and co loaded liposome technology enhancement platforms, and the use of ginsenosides instead of traditional cholesterol molecular layers, demonstrates their active layout in the global market.

The main challenges facing the liposome nutrition market are high production costs and limited consumer awareness. The cost of liposome supplement formulations may be 3-5 times higher than traditional formulations, mainly due to special packaging techniques and strict quality control processes.

The production of liposome supplements requires advanced infrastructure, strict temperature control, and high-quality raw materials, which makes the product relatively expensive and to some extent limits its popularity in the market. Especially in price sensitive areas, this challenge is more pronounced.

However, the market also contains enormous opportunities. The combination of liposome delivery system and personalized nutrition is an important innovative direction.

The article published in Frontiers in Nutrition in October 2023 pointed out that personalized nutritional supplements powered by liposome delivery systems are becoming a promising solution that can improve compliance and effectiveness, especially for populations with chronic diseases or nutrient malabsorption.

Liposome technology has brought back attention to some nutrients that were previously marginalized due to low bioavailability, such as resveratrol, glutathione, curcumin, and other ingredients that have re entered the mainstream product matrix through liposome technology. This has opened up a new path for the industry's "traditional component" second growth curve.

The future liposome nutrition market will show a diversified development trend. From a technical perspective, liposome delivery systems will be more closely integrated with personalized nutrition. The integration of artificial intelligence and big data in the field of nutrition enables companies to provide personalized supplementary solutions based on user specific biomarkers, lifestyle data, and health goals.

Formulation innovation is also one of the future development directions. At present, liposome products have expanded from traditional capsule forms to various dosage forms such as liquids and powders. For example, the new liposome Ashwagandha launched by German nutrition manufacturer ActiNovo is a liquid form, which can be directly drunk or added to fruit juice.

In terms of application fields, liposome technology is expanding from dietary supplements to medical treatment and cosmetic enhancement. For example, DERMAFIRM applies liposome technology to skincare products to increase the skin penetration rate of active ingredients.

Cross border technology migration will become an important source of industry innovation. The technological breakthroughs in the future nutrition industry may come from fields such as biomedicine, cosmetics, and even the pet industry and materials science. Only enterprises that truly master core technologies can win long-term competitive advantages in this industry reshuffle.

In the next decade, as liposome technology continues to optimize and production costs gradually decrease, this market will continue to expand. Transparency Market Research predicts that by 2034, the global market size of liposome nutritional supplements will reach $741 million.

The more profound impact is that liposome technology is changing the innovation logic of the nutrition industry - from simple ingredient stacking to precise delivery, and from extensive marketing to technological empowerment. Enterprises that can master core technologies and effectively reduce production costs will gain sustained competitive advantages in this industry transformation.

This is the first one.